APN Prestige Group: 2025 Investor Insight Report

The Australian real estate market continues to be a pivotal arena for investors seeking sustained returns and growth. As we delve into 2025, residential property investors in Australia are poised to capitalize on numerous opportunities driven by evolving market dynamics. This report provides a comprehensive analysis tailored to guiding sophisticated investors and aspiring property owners in making informed and strategic decisions.

Emerging Trends in the Australian Real Estate Market

Migration Patterns: With border reopenings post-pandemic, Australia is experiencing an influx of skilled migrants, increasing demand for residential properties.

Interest Rates: Anticipated stabilization in interest rates is expected to maintain buyer confidence and borrowing capacity.

Supply Constraints: Ongoing issues in construction supply chains are constricting housing supply, potentially driving up property prices.

Government Incentives: Enhanced first-home buyer grants and tax incentives continue to stimulate investor interest, especially in new builds.

High-Performing Regions for Capital Growth and Yield

Victoria (VIC)

Melbourne Suburbs: Suburban growth corridors like Werribee, Melton, and Craigieburn are showing consistent capital growth.

Regional VIC: Areas such as Ballarat, Bendigo, and Shepparton offer high yield potential due to increased regional migration and lifestyle preferences.

Queensland (QLD)

Brisbane Growth: Emerging suburbs near the CBD such as Rochedale, Chermside, and Springfield are benefiting from infrastructure developments, showing strong price gains.

Gold Coast and Sunshine Coast: Continues to be attractive for investors, showing robust rental yields, especially in areas like Coomera, Southport, and Maroochydore.

Western Australia (WA)

Perth’s Resurgence: After a subdued period, Perth’s property market is bouncing back, making it attractive for capital appreciation, particularly in suburbs such as Baldivis, Ellenbrook, and Byford.

Asset Type Comparison

| Asset Type | Capital Growth | Yield Potential | Entry Cost | Ideal For |

|---|---|---|---|---|

| Co-living | High | Very High | Medium | Yield-focused investors |

| Duplex | High | High | Medium-High | Upsizers and experienced investors |

| Townhouses | Moderate | Moderate | Medium | First-time investors |

| NDIS Properties | Moderate | High | High | Long-term passive investors |

| House & Land | High | Moderate | Medium | Growth-focused and new investors |

Strategic Opportunities for Investors

First-time Investors: Leverage government incentives to enter growth corridors with affordable price points, such as house & land in Melton or townhouses in Ipswich.

Seasoned Investors: Diversification into under-supplied markets like co-living in Logan or NDIS properties in Ballarat can enhance portfolio performance.

Insights for Tax Benefits and Long-term Growth

Tax Benefits: Investments in new properties can attract depreciation benefits (e.g., Division 40 & 43 deductions) and loan interest write-offs, improving cash flow.

Positive Gearing: Target high-yield areas like Logan (QLD) and Werribee (VIC) to maintain positive rental income after expenses.

Portfolio Growth: Use equity from high-growth assets to fund purchases in emerging markets, building a diversified and scalable property portfolio.

Visual Analysis

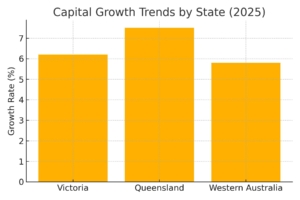

Capital Growth Trends by State (2025)

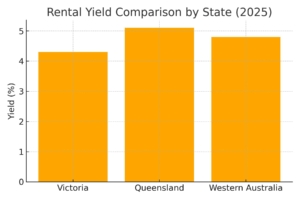

Rental Yield Comparison by State (2025)

Table: Market Overview by Region and Asset Type

| Region | Entry Cost Range | Avg. Capital Growth (2025) | Avg. Rental Yield | Asset Types |

|---|---|---|---|---|

| Melbourne Suburbs | $550K–$750K | 6.2% | 4.1% | House & Land, Townhouses |

| Regional VIC | $450K–$650K | 5.7% | 5.0% | House & Land, NDIS |

| Brisbane Suburbs | $500K–$700K | 7.5% | 5.2% | Duplex, Townhouses, Co-living |

| Gold/Sunshine Coast | $600K–$850K | 6.9% | 5.4% | House & Land, Co-living |

| Perth Suburbs | $450K–$600K | 5.8% | 4.8% | House & Land, Duplex, NDIS |

Call to Action

Unlock the full potential of the Australian property market by partnering with APN Prestige Group for tailored investment advice. Engage with our experts to navigate and excel in the ever-evolving real estate landscape. Contact us today for personalized strategies that align with your investment goals.

📞 Call us on +61 489 267 176

📧 Email: info@apnprestigegroup.com.au

🌐 Visit: www.apnprestigegroup.com.au

APN Prestige Group – Property Investment. Built on Strategy. Backed by Data.